Tax Uncertainty Equals Income Uncertainty

It has been said that there are only two certainties in life: death and taxes. While only our maker knows when we will die, we know that every April 15, Uncle Sam will require us to pay our taxes. Yet, with a proper strategy, we can take steps to help minimize the impact taxes will have on our after-tax income in retirement. Tax allocation is an approach that many nearing retirement or already in early retirement may wish to consider to help prepare for a changing tax environment.

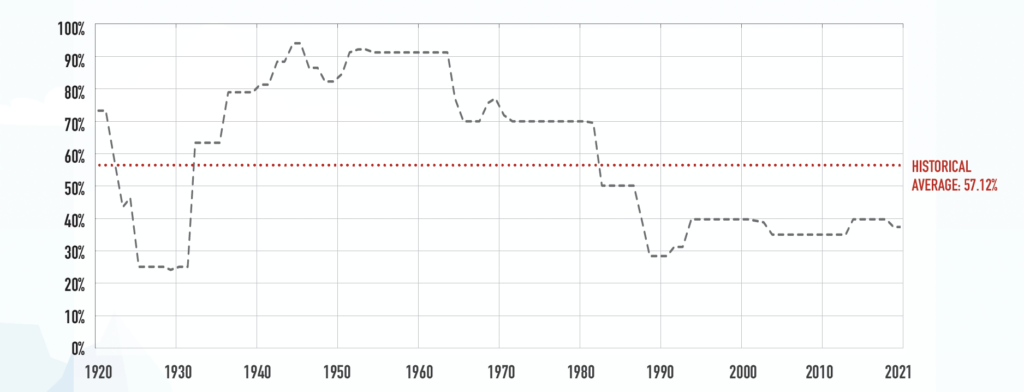

Historical Top Marginal Tax Rates

Today, most retirement savings are in IRAs and 401(k)s. Those assets, when withdrawn, are subject to taxes. But since future tax rates may be higher than they are today, the after-tax value of those assets is uncertain. Tax uncertainty therefore translates info income uncertainty. Do you think future tax rates will be the same, lower, or higher than they are today?

Where are your retirement assets?

Having retirement savings in a variety of vehicles can provide you flexibility, should tax rates change.

We are here for you year-round, whenever you need us!