Inflation in Retirement

As clients prepare for and enter retirement, several factors need to be evaluated to ensure a successful and sustainable retirement lifestyle. One of the factors that must be considered is the long-term effect of inflation. However, while many clients and financial professionals assume they understand inflation, it tends to be a very nuanced issue. Specifically, inflation is often treated as a uniform experience and a constant. As a result, the impact of inflation on a retirement income strategy can create outcomes that are neither accurate nor dependable.

What is Inflation?

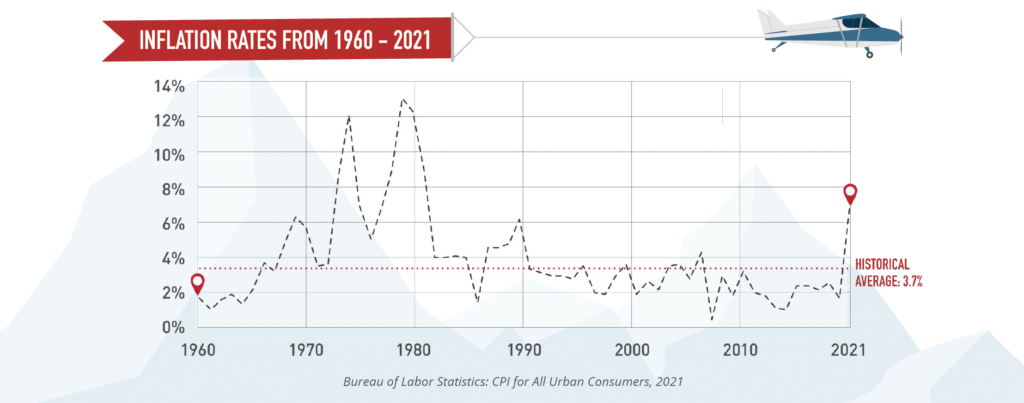

Inflation is simply the increase in the cost of goods and services over time. Even modest inflation levels like we have experienced over the past 20 years can deflate a retiree’s ability to cruise through retirement while maintaining purchasing power.

We are here for you year-round, whenever you need us!