Healthcare Costs in Retirement:

Expect the Unexpected

Healthcare continues to be one of the great financial mysteries of retirement income planning. The healthcare system is a complicated network of rules, billing codes, and insurance options. But with increased longevity and advances in medical care, funding the long-term healthcare needs of today’s retiree can challenge even those who have saved sizable retirement nest eggs. For many, the ability to pay for 30-plus years of out-of-pocket healthcare expenses will be a daunting task.

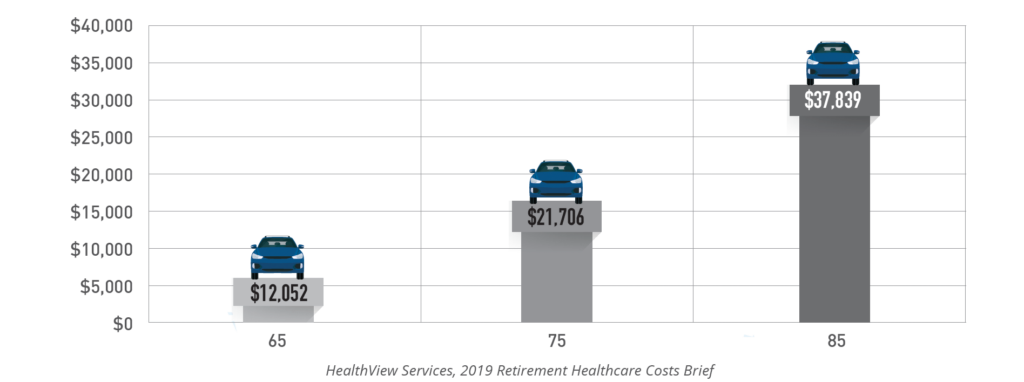

Annual Out-of-Pocket Healthcare Costs

Healthcare costs continue to be one of the largest, most unpredictable expenses in retirement. As retirees age, out-of-pocket costs only increase. This ever-increasing expenditure can be detrimental to finances in retirement.

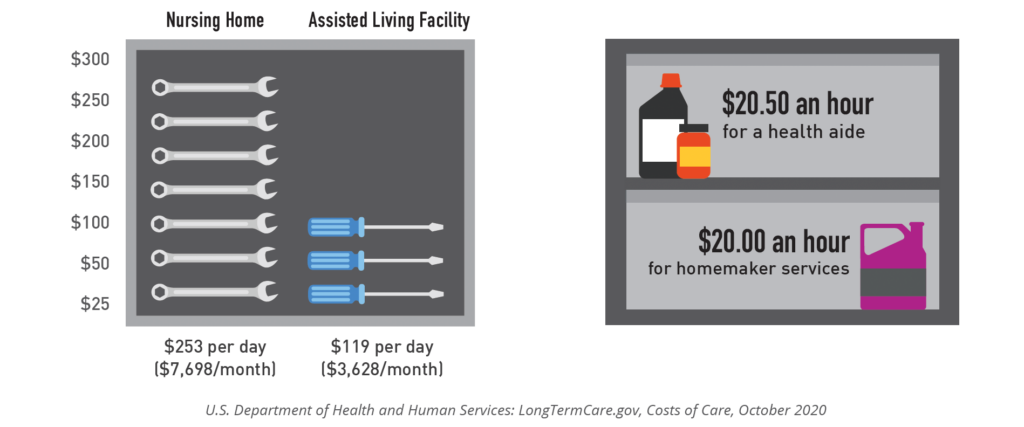

National Average For Long-Term Care Costs

One of the most challenging expenses to plan for relates to long-term care events. With a national annual median cost for a private room in a nursing home exceeding $92,000, many opt to explore in-home care options. And while Medicare can cover part-time in-home “intermittent” skilled nursing and short-term stays at a skilled nursing facility, Medicare will not pay for 24-hour-a-day care, homemaker services, or personal care services.

Healthcare Risk

We are here for you year-round, whenever you need us!